how much is a million dollar life insurance policy for a 60 year old

As you can see blending a whole life policy with. How Much Is A Million Dollar Life Insurance Policy For A 60-Year-Old When you reach the age of 60 you might need life insurance.

How To Buy A 1 Million Life Insurance Policy And When You Need It

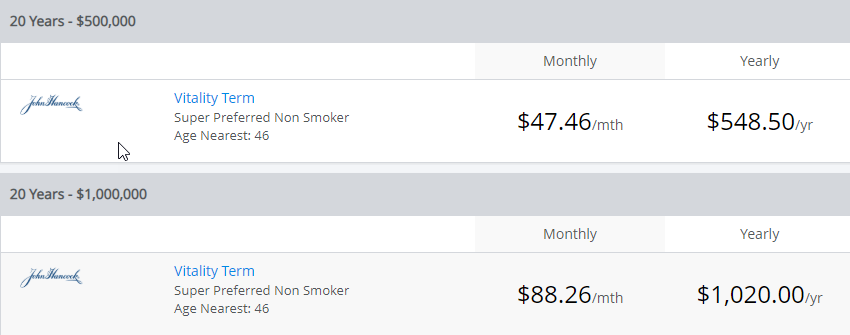

Taken over the 15 insurance companies shown above the average cost for 20 years of coverage was.

. The cost of a million-dollar life insurance policy can vary from a few hundred dollars to thousands of dollars per year depending on certain variables. The cost of a million-dollar life insurance policy varies based on your age health and other risk factors. Here is an illustration example of a blended whole life policy.

This table shows monthly rates for 10 20 and 30-year term life insurance policies with a death benefit of 1000000 for men between 30 to 60 years old. The two exceptions for 4 million of life insurance and 5 million of life insurance is for the 80 year old which is a guaranteed universal life quote which had to be quoted since no. Below are the rates for a 10000000 million universal life insurance policy no lapse guarantee for a male to age 121 years old at the preferred plus health class.

Cost of 2 Million Term Policy Monthly Premium. Life insurance at the age of 60s makes sense. Average 10 year term life insurance rates for a 500K policy for women sixty five to seventy five years of age.

Waiting from age 30 until age 40 to buy can. A 1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. 200000 Income x 3 years 600000 Life Insurance.

But if you cant afford the annual premiums you can also choose monthly pay as I show here. The premiums shown in the table below are for women in good health and non. So if youre a 40-year-old male.

A 10-year 2000000 life insurance policy for 32 per month. For example a 25-year-old non-smoking female might pay 3345 per. A 40-year-old non-smoking female can pay under 45month.

Using Term Life Insurance as an example a 40-year-old male who is underwritten at the best possible rate class Preferred Plus could expect to pay 30 per month for 1 million in life. He can save money and still maintain good life insurance protection by buying the following policies. A one million dollar term life insurance policy may seem excessive but there are many reasons a person may need a 1 million dollar policy.

50 per month or 12000 in. Many people either need more than a million-dollar death benefit or are above. 30 per month or 7200 in total.

A million-dollar life insurance policy covers both needs. At age 30 term life insurance rates for males are around 19 more expensive than for females for a 500000 20-year term policy. Age 10 Year Term.

How Much Does A Million Dollar Life Insurance Policy Cost

![]()

What Does A Million Dollar Life Insurance Policy Cost In 2020

10 Million Dollar Life Insurance Policy Cost Policymutual Com

How Much Does A Million Dollar Life Insurance Policy Cost Forbes Advisor

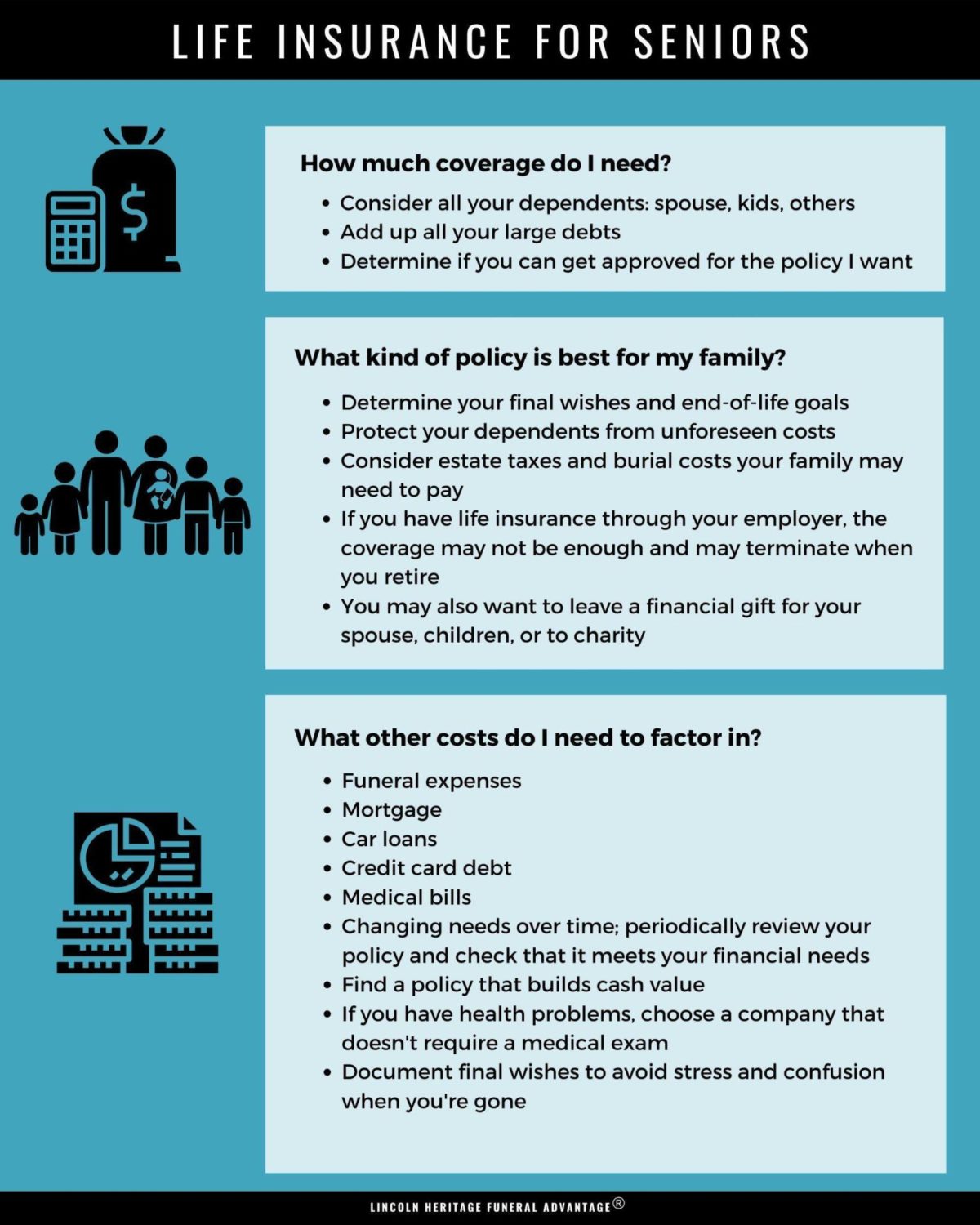

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Buy A Million Dollar Life Insurance Policy For Cheap From 15 Month

How Much Does A Million Dollar Life Insurance Policy Cost

International Life Insurance Plans For Expats And Global Citizens

How Much Does A Million Dollar Life Insurance Policy Cost

How Much Does A Million Dollar Life Insurance Policy Cost

Compare Million Dollar Life Insurance Policy Rates Top 5 Companies

Million Dollar Life Insurance Policy Cost For Men And Women Get 1 000 000 Quotes

2022 Final Expense Insurance Guide Costs For Seniors

10 Million Dollar Life Insurance Policy Cost Policymutual Com

Best Life Insurance For Seniors

Truth About The Million Dollar Life Insurance Policy With Rates Pinnaclequote

10 Million Dollar Life Insurance Policy Cost Policymutual Com

The Best Affordable Life Insurance For Seniors Up To Age 85 2022